Having a kid? Thinking about saving money for their future needs such as driving lessons, university, or a deposit?

Save some money for them!

Contents

Cash vs investments 💸

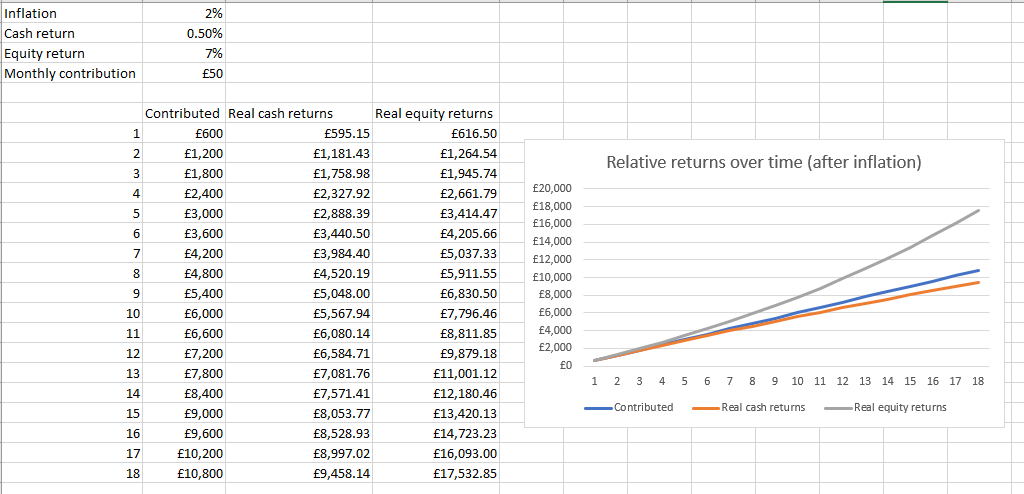

If your child is young, you should consider investments over cash accounts, as over long periods stocks are very likely to outperform cash, and thus avoid inflation eroding your child’s savings.

An example of this in action over 18 years:

If you’re new to investing, don’t be daunted! Start with our Investing 101 page and try our Recommended Resources for more in depth guides.

Types of account 🏦

JISA (Junior ISA)

Suitable for:

✅ Money for your child to use when they turn 18

✅ Family members who want to save for a child’s future directly

Not suitable for:

⛔ Money you want to provide for a specific purpose (e.g. a house deposit)

Junior ISAs come in Cash and S&S variants, much like regular ISAs, and follow similar rules.

Saving into a Junior ISA will not use any of your personal allowance – your child has their own allowance, of £9,000 per year. Only a parent or guardian can set up a JISA, but once it’s set up, other family members or friends can contribute money to it. The parent who opened it remains responsible for managing the account (keeping contact details up to date and making investment decisions) but they cannot withdraw money from the JISA.

When the child turns 16, they are given control over the JISA, but cannot yet withdraw funds from it. On the child’s 18th birthday, the JISA becomes a standard adult ISA. These have no restrictions on withdrawals.

Note that in the tax year in which the child turns 18, they have both a £9,000 JISA allowance and the standard £20,000 ISA allowance.

More info: https://www.moneysavingexpert.com/savings/junior-isa/

Your own ISA (or pension)

Suitable for:

✅ Flexible help with education, home deposit, and other costs

If you’d like to save money for your child’s future but not necessarily for them to have full access to spend at 18, you will need to keep the savings in your own name. This allows you to gift the money to your child at whatever point(s) you consider to be appropriate, such as to pay for living costs during University or to buy a home.

The most common choice for this will be to save in an ISA, but if the timing works you can also consider using your pension.

If you are saving for your own financial plans and your children in your own name but want to keep a strict division between your saving and theirs, you can do so in a few ways:

- Open a separate ISA or SIPP for your child’s savings

- Use separate funds for your and your child’s savings. For example, if you are using index funds you can pick two different ones.

- If using a single fund, you can make a note of how many units were purchased each time you invest for yourself or your child (your broker will provide this information). That way when you end up with a holding of n units, you’ll know how many were purchased for yourself and how many for your child/children.

- Some platforms have functionality for tracking and dividing up your investments.

Be aware that in the event of your death these savings may be subject to inheritance tax – the money is legally yours. You should make sure your will reflects any specific requests, and that your pension Expression of Wishes is up to date.

Junior SIPP

Suitable for:

✅ Helping your child save for retirement

Not suitable for:

⛔ Living expenses, higher education, home deposit, etc

If you want to give your child a head start on retirement savings, you can contribute £2880 a year into a JSIPP. This will get tax relief at 20% giving a maximum total contribution of £3600 a year.

When your child turns 18 this will become a regular SIPP and will be accessible according to the normal personal pension rules.

Over 60 years the power of compound interest is huge, so this is potentially worth considering. It could also provide a useful teaching tool about long term investments.

Note that of course this money can’t be used to help your child with university costs, to buy their first home, or any other goals before retirement age. Bear in mind that your child will have several decades to prepare for their own retirement, and may benefit more from help with financial goals earlier in their life.

LISAs

Suitable for:

✅ Saving for a deposit

Not suitable for:

⛔ Children under 18

Lifetime ISAs are available in cash and S&S variants, and provide a bonus top-up to savings if used for a first home or retirement. It is possible to withdraw money for other purposes, but the bonus is lost along with a small further penalty, designed to discourage this.

You must be between 18 and 40 years old to open a LISA – they cannot be opened on behalf of a child. You can of course encourage your child to do so when they turn 18, and help them use their allowance.

Mix and match?

You don’t have to keep all your savings in the same ‘pot’, you can make use of all of these strategies in whatever combination or proportion works for your family.

What if I want my children to have money they can’t access until age 21, 25, etc?

This is a commonly asked question, and understandable too. Perhaps you would prefer not to hold your children’s savings in your own name (whether for personal or tax reasons), but are concerned that at 18 your children won’t be best equipped to make sensible long-term decisions about their lifetime wealth.

Unfortunately, there is no simple and inexpensive way to put savings in your child’s name that do not become accessible to them when they become a legal adult. Any arrangement in which your child is the beneficial owner of these savings, but unable to access them at 18, is known as a relevant property trust in law. These have complicated legal and tax arrangements.

The simplest thing is to either save in your own name (paying any applicable taxes), or to give the gift outright (via JISAs or other children’s savings accounts). Or of course some combination of the two.

If you are considering setting up a trust, you should speak to a private client solicitor and/or a financial planner to fully understand the tax and legal implications, as well as the administrative costs. Expect total costs to be in the thousands of pounds.

What if I just don’t tell them about their JISA until they’re old enough to use it responsibly?

The bank will contact your child about their JISA when they turn 16. It’s not legal to intercept this and continue running their ISA yourself (just as it would not be for them to do to you). Again, money in a JISA belongs to your child and you should not contribute more to a JISA than you want them to have full access to when they reach adulthood.